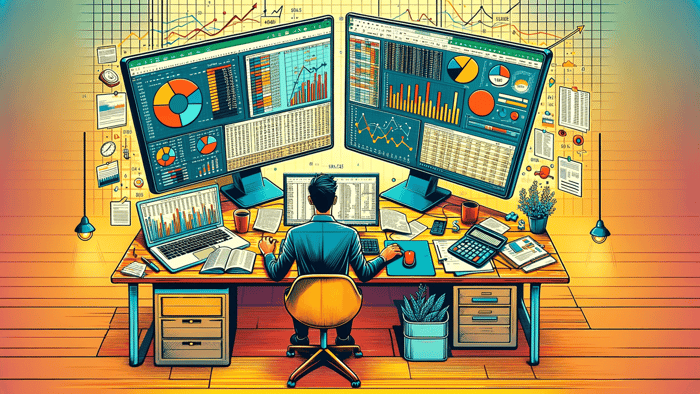

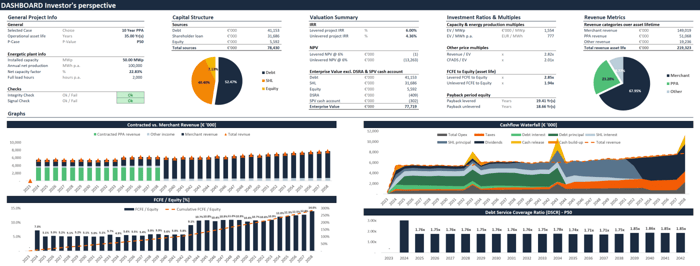

Top Project Finance Modeling Shortcuts (Windows and Mac)

In project finance modeling, efficiency and precision are key. Whether you're using a Windows PC or a Mac, mastering the most commonly used project finance modeling shortcuts can significantly speed up...