The Debt Service Reserve Account (DSRA) protects a lender against an unexpected decrease in cash flow available for debt service (CFADS). The DSRA ensures that the debt provider receives the debt service in a given period, even though the operational cash flow falls short of sufficiently covering the debt service. This cash reserve account is usually established during the construction period or filled up with the target amount during the first months of operation.

The DSRA releases cash each time the debt service coverage ratio (DSCR) falls below 1, specifically when there is a gap to be billed between CFADS and debt service (interest and principal payment). During the negotiation and finalization of the facility agreement between the project SPV and the lender, a target profile for each period within the lending period is predetermined using a financial model. As a result, the DSRA is typically dimensioned to cover six months of forward-looking principal and interest payments.

How to implement a Debt Service Reserve Account within a financial model?

Integrating a DSRA into a financial model is rather complex, as different cash releases and funding movements must be considered. In addition, the implementation of the DSRA might cause an interdependency of different variables resulting in a circular reference that has to be broken using a macro similar to the debt sculpting procedure in accordance with a target DSCR.

Below is an example of how a DSRA might be implemented within a financial model for renewable energy investments using market best practices.

Cash movement considerations for modeling purposes

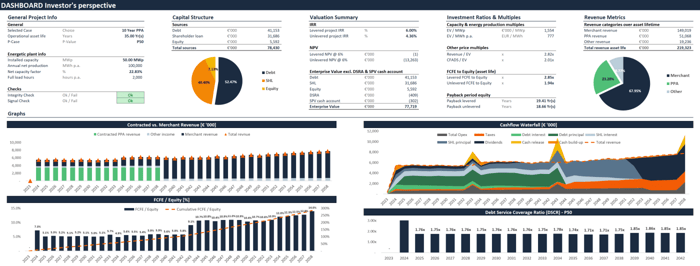

The above example shows the different cash movements that need to be considered for adequately modeling the cash account. So let's take it one at a time!

- Initial funding from sources: The first line item in the account is the funding from sources which occurs only once at the end of construction. In our example above, the initial funding is approximately 359,000 EUR. However, you might notice that the balance quickly rises to over 1.5 mEUR within the first two years of operation. Due to a grace period of 12 months, the debt service in the first operational year consists of interest payments only, resulting in a low initial funding need, given a target DSRA balance of 6 months of forward-looking debt service.

- Funding from cash flow: Once construction is over and the solar park or wind farm is operational, the funding will occur from operational cash flow. At the end of each operational quarter, the 6 months of forward-looking debt service are considered to determine potential additional funding needs. If additional funding needs are required, this gap will be filled only if sufficient cash flow for the DSRA is available. In the model above, you can see how this funding need is calculated at the bottom of the screenshot, which flows into line item 1080.

- Release due to cash flow shortfall: If the project does not generate sufficient operating cash flow in a certain period, there will be a release from the DSRA to cover the shortfall in debt service. Once the project reaches sufficient cash flows again, the DSRA will be filled up again in the periods thereafter.

- Release due to excess account funding: Banks typically require the project SPV to hold sufficient cash in the DSRA to cover 6 months of forward-looking debt service. So if the account balance of the DSRA is too high, the equity owner is allowed to release this extra cash. In row 1082, you can see how excess cash will be treated in the third quarter of 2025. You might wonder why the account is so overfunded in this period? As the two-quarters of debt service ahead are Q4 2025 and Q1 2026, there are comparatively low CFADS available due to the seasonality of the solar project. In the above example, a sculpted debt financing structure is in place, which causes debt service in the summer months to be higher than during the winter months. Consequently, excess cash is available in the DSRA at the end of the year's third quarter.

How to build an advanced financial model for renewable energy investments?

Do you want to learn how to adequately implement a Debt Service Reserve Account within a financial model created explicitly for renewable energy investments? Then check out the Advanced Renewable Energy Financial Modeling course.