Building an advanced project finance model in Excel can be a challenging but rewarding experience that will enhance your financial modeling skills and set you apart from your peers. By reading and applying the concepts of our financial modeling user guide, taking the underlying video courses, and using our financial models, you will gain a valuable skillset that is highly sought after in the finance industry.

What is project finance?

Project finance is a financing structure that provides funding for a specific project, typically a large-scale infrastructure or capital-intensive project. In project finance, the project itself is used as collateral for the financing rather than relying on the creditworthiness of the sponsor or the company behind the project. This means that the lenders and investors look to the future cash flows generated by the project as the source of repayment rather than relying on the sponsor's balance sheet.

Project finance is typically used for large, complex projects that require significant capital investment, such as building a renewable energy power plant, a mine, a pipeline, or a telecommunications network. The main objective of project finance is to allocate risk in a way that minimizes the impact on the sponsors and lenders while providing a stable source of financing for the project. Project finance can help to reduce the risk for lenders and investors, align the interests of all parties involved, increase transparency and accountability, and support the development of infrastructure and capital-intensive projects.

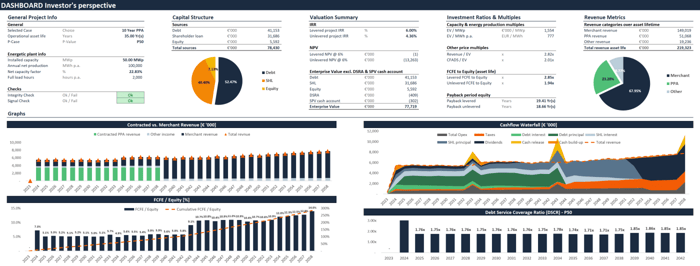

Enhance the decision-making process of your organization with a comprehensive financial model dashboard.

If you're looking to invest in renewable energy, you need a comprehensive financial model dashboard that summarizes all the key investment metrics relevant to your decision-making process.

This financial model dashboard for renewable energy investments is designed to help you make informed investment decisions with ease. It includes a detailed breakdown of the project's capital structure, allowing you to understand the financing mix of the project and the risks associated with each layer of the capital stack.

The dashboard also considers critical investment metrics such as IRR and NPV on both a levered and unlevered basis, giving you a complete picture of the project's profitability.

In addition to these essential investment ratios and multiples, the dashboard details the payback periods, CFADS/EV, Revenue/EV, EV/MWp, and EV/MWh. These metrics are crucial in evaluating the financial viability of the project and determining its potential for generating returns over the long term.

The dashboard also features eye-catching charts that provide a visual representation of the project's cash flow generation over its entire asset lifetime. This feature will give you valuable insights into the project's cash flow patterns and help you make informed investment decisions.

With all these critical investment metrics and data points in one place, this financial model dashboard is the ultimate tool for renewable energy investment decision-makers.

How to build a project finance model from scratch?

Do you want to learn how to build a project finance model from scratch? Then check out the Advanced Renewable Energy Financial Modeling course.