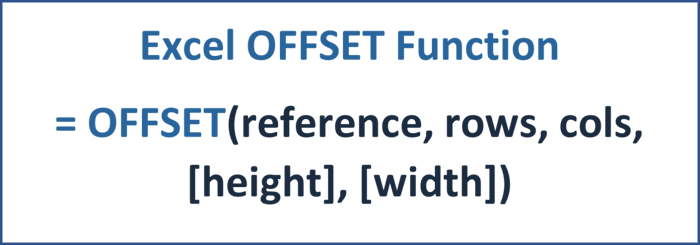

The OFFSET function in Excel returns a reference to a range that is offset by a certain number of rows and columns from another cell or range of cells.

How to use the OFFSET function in Excel?

The OFFSET function in Excel is a powerful tool for referring to different cells and ranges of cells. So let's look at each argument of the function.

1. Reference: This is the starting cell or range of cells that you want to use as a reference.

2. Rows: This is the number of rows that you want to offset from the reference. A positive number will move down, while a negative number will move up.

3. Columns: This is the number of columns that you want to offset from the reference. A positive number will move to the right, while a negative number will move to the left.

4. Height (optional): This is the number of rows that you want the returned reference to be.

5. Width (optional): This is the number of columns that you want the returned reference to be.

Here's an example of how to use the OFFSET function:

Suppose you have a list of data in cells A1:B10, and you want to return a reference to the range that is 3 rows down and 2 columns to the right of cell A1. You can use the following formula:

=OFFSET(A1, 3, 2)

This will return a reference to cell C4. You can also use the optional height and width arguments to return a range of cells. For example:

=OFFSET(A1, 3, 2, 2, 3)

This will return a reference to the range C4:E5 (2 rows high and 3 columns wide).

You can use the returned reference in other functions, such as SUM or AVERAGE, to perform calculations based on the offset range.

What is an example of a practical use of the OFFSET function in a renewable energy financial model?

When modeling the target balance of a Debt Service Reserve Account (DSRA) in a project finance deal, the OFFSET function comes in handy.

During the negotiation and finalization of the facility agreement between the project SPV and the lender, a target DSRA profile for each period within the lending period is predetermined using a financial model. As a result, the DSRA is typically dimensioned to cover six months or two quarters of forward-looking principal and interest payments.

But what if the financial model should have the flexibility to change the forward-looking debt service for the DSRA target balance to be flexible depending on one input?

In the above best-practice model, an input for the DSRA target balance is given as two quarters of the forward-looking debt service. However, the end user can easily adjust this forward-looking input which then flows into the OFFSET function.

In this case, we don't want to offset any rows and columns from the reference and only need a height of one row which is the row of the total debt service in each specific period. However, with the last argument of the OFFSET function, we want the width of the row to be flexibly adjustable by our given input.

How to properly apply the OFFSET function in a financial model for renewable energy investments?

Do you want to learn how to model the OFFSET function within a financial model created explicitly for renewable energy investments? Then check out the Advanced Renewable Energy Financial Modeling course.

Article sources