The debt service coverage ratio (DSCR) determines how much the cash flow available for debt service (CFADS) exceeds the total scheduled debt service, i.e., debt principal and interest, in any given period. Depending on the project's riskiness, i.e., the uncertainty of energy production or the contractual basis of cash flows, debt financing banks are willing to give specific minimum DSCR targets for sculpted repayment structures.

A solar PV plant in Spain with low uncertainty in energy production and a government-backed long-term remuneration scheme according to a feed-in tariff (FiT) might have a minimum DSCR target of 1.30x on a P50 basis. However, a wind farm in Finland with high uncertainty and volatility in energy production and no contractually backed cash flow offtake-agreement in place (i.e., no feed-in tariff (FiT) nor Power Purchase Agreement (PPA)) might have a minimum DSCR target of 1.70x or higher on a P90 basis.

Below is an example of how the DSCR profile of a pay-as-produced PPA-backed solar plant in Spain on a P90 basis may look like.

The above DSCR profile corresponds with the below cash flow waterfall. You might notice that most of the cash flow in the first 20 years of operation will go to the lending bank in the form of debt interest and principal. But why would an asset owner want to give away most of the early cash flows?

A capital structure with high leverage would enable the equity investor and/or developer to realize the asset with significantly less equity capital. This results in an improved equity IRR, although the absolute cash return in the early years might not be optimal.

Capital structure - a significant value driver for renewable energy investments

The capital structure is one of the most important value drivers for renewable energy investments.

Increase of equity IRR through leverage: Typically, the cost of debt financing is much cheaper than the cost of equity. Therefore, if a project can take on a significant portion of the debt, this increase in leverage - also referred to as gearing - can increase the equity IRR significantly. Institutional investors often require a minimum rate of return which implies that if the overall equity IRR can be increased using debt, the asset's enterprise value can be improved until the equity IRR is back to its minimum rate of return.

Below is the valuation dashboard used in our Advanced Renewable Energy Financial Modeling course. This online video course teaches you how to build a financial model with advanced capital structures from scratch.

The Debt Service Reserve Account (DSRA) protects lenders against debt service shortfalls under aggressive financing structures.

The Debt Service Reserve Account (DSRA) protects a lender against an unexpected decrease in cash flow available for debt service (CFADS). The DSRA ensures that the debt provider receives the debt service in a given period, even though the operational cash flow falls short of sufficiently covering the debt service. This cash reserve account is usually established during the construction period or filled up with the target amount during the first months of operation.

The DSRA releases cash each time the debt service coverage ratio (DSCR) falls below 1, specifically when there is a gap to be billed between CFADS and debt service (interest and principal payment). During the negotiation and finalization of the facility agreement between the project SPV and the lender, a target profile for each period within the lending period is predetermined using a financial model. As a result, the DSRA is typically dimensioned to cover six months of forward-looking principal and interest payments.

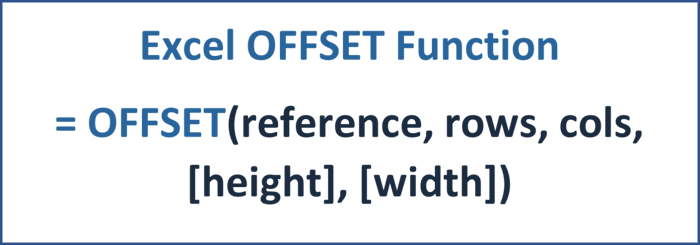

How to properly reflect the Debt Service Coverage Ratio (DSCR) in a financial model for renewable energy investments?

Do you want to learn how sophisticated investors value their investments in accordance with a sculpted debt structure in accordance with a target DSCR using a financial model created explicitly for renewable energy investments? Then check out the Advanced Renewable Energy Financial Modeling course.