In the center of a project finance deal, there is typically a Special Purpose Vehicle (SPV), which is a separate legal entity established solely for the purpose of the project. The SPV is created to ring-fence the project from the risks associated with the parent company and to facilitate the allocation of risks among the project participants.

Around the SPV, four main categories of agreements can be differentiated: Investment Agreements, Operating Agreements, Financing Agreements, and Electricity Offtake Agreements. Each of these agreement categories is critical for the success of the project and involves various parties.

1. Investment Agreements

The Investment Agreements in a Project Finance Deal involve the project developer and the Engineering, Procurement, and Construction (EPC) contractor. An Engineering, Procurement, Construction, and Management (EPCM) agreement is in place between the project developer and the EPC contractor. This agreement governs the overall management of the project and covers issues such as project scope, project schedule, quality control, and change orders.

Additionally, a Turbine Supply Agreement (TSA) or Module Supply Agreement (MSA) is in place between the EPC contractor and the technology supplier. This agreement outlines the terms and conditions for the supply of turbines or modules for the renewable energy project.

These contractual relations ensure the SPV that the project is built to specification, within the specified timeline, and at the agreed-upon cost. This provides certainty to the SPV, which can then proceed with the other agreements required for the project.

2. Operating Agreements

The Operating Agreements in a Project Finance Deal are critical for the ongoing operation of the project. The agreements include:

1. Land lease agreements: The SPV enters into a land lease agreement with the landowner to secure the land required for the project.

2. Insurance agreements: The SPV enters into insurance agreements to protect against risks such as damage to equipment, natural disasters, and liability.

3. Technical & commercial management agreement: The SPV enters into a technical & commercial management agreement to manage the operation of the project.

4. Operation & maintenance agreement (O&M): The SPV enters into an O&M agreement to ensure that the project is maintained and operated at optimal levels.

There might be many more operating agreements in place between the SPV and its respective contractual counterparts, but the above-mentioned are the most typical operating agreements of a renewable energy project.

3. Financing Agreements

Financing Agreements are critical to securing the funds required for the project. The agreements include:

1. Sponsor (equity provider) agreement: The sponsor (equity provider) agrees to provide equity financing to the SPV to fund the project.

2. Lender (debt provider) agreement: The lender (debt provider) agrees to provide debt financing to the SPV to fund the project.

These agreements ensure that the SPV has the necessary funding to complete the project and meet its financial obligations.

4. Electricity Offtake Agreements

The Electricity Offtake Agreements in a Project Finance Deal govern the sale of electricity generated by the project. The Power Purchase Agreement (PPA) is the most common offtake agreement. It is an agreement between the SPV and the offtaker to purchase the electricity generated by the project at a predetermined price. This agreement provides certainty to the SPV regarding the sale of the electricity generated by the project and helps to secure financing for the project.

In summary, the contractual relations of a project finance deal involve Investment Agreements, Operating Agreements, Financing Agreements, and Electricity Offtake Agreements. These agreements involve various parties and are critical for the success of the project. The agreements provide certainty to the SPV and ensure that the project is built, operated, and financed in a manner that meets the requirements of all parties involved in the Project Finance Deal.

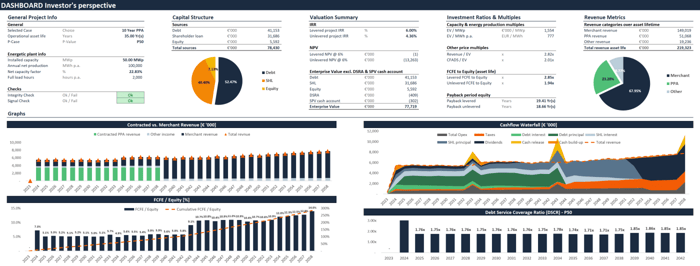

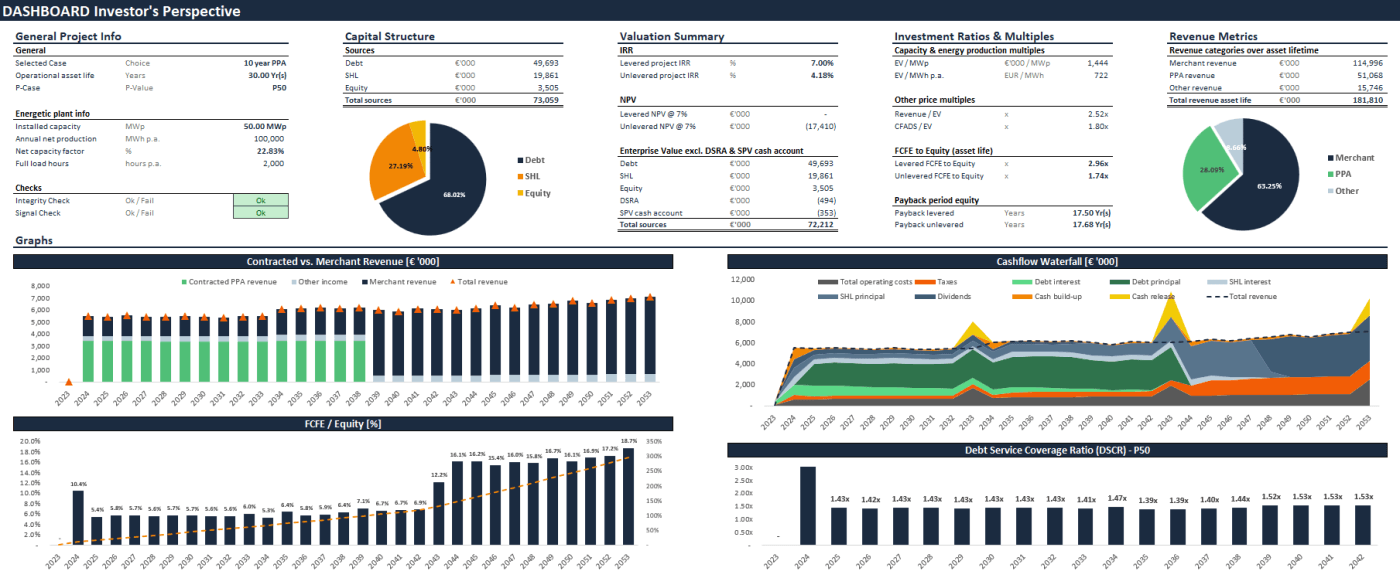

Enhance your organization's decision-making process with a comprehensive financial model dashboard.

If you're looking to invest in renewable energy, you need a comprehensive financial model dashboard that summarizes all the key investment metrics relevant to your decision-making process.

This financial model dashboard for renewable energy investments is designed to help you make informed investment decisions with ease. It includes a detailed breakdown of the project's capital structure, allowing you to understand the financing mix of the project and the risks associated with each layer of the capital stack.

The dashboard also considers critical investment metrics such as IRR and NPV on both a levered and unlevered basis, giving you a complete picture of the project's profitability.

In addition to these essential investment ratios and multiples, the dashboard details the payback periods, CFADS/EV, Revenue/EV, EV/MWp, and EV/MWh. These metrics are crucial in evaluating the financial viability of the project and determining its potential for generating returns over the long term.

The dashboard also features eye-catching charts that provide a visual representation of the project's cash flow generation over its entire asset lifetime. This feature will give you valuable insights into the project's cash flow patterns and help you make informed investment decisions.

With all these critical investment metrics and data points in one place, this financial model dashboard is the ultimate tool for renewable energy investment decision-makers.