While the units kW and kWh may seem very similar, they are two fundamentally different things, especially when it comes down to modeling a renewable energy investment. Still, many people in the renewables industry seem to get confused about this topic. Talking to clients, colleagues, or supervisors, mixing up kW and kWh may make the difference between sounding like an expert or a rookie.

So what's the difference between kW and kWh?

The simple difference between kW and kWh is that a kilowatt (kW) measures power, and a kilowatt-hour (kWh) measures energy, or more specifically, electricity.

Power (kW) is the rate at which a wind farm, solar plant, or any other renewable energy asset or conventional power plant produces electricity. It is also the rate at which your kitchen appliances, television, or computer use electricity.

While power (kW) represents the electricity usage rate, electricity (kWh) reflects the total amount of energy used over a specific period. Ultimately, it all comes down to time! To make it simple to understand, let's look at an example.

How much electricity does your rooftop solar plant produce in one year?

Let's suppose that you just decided to invest some of your savings in a brand-new rooftop solar plant for your house. The plant's total installed capacity (or power) is 10 kWp. By the way, the power of a solar plant is measured in kWp (kilowatt peak), which is essentially also a unit for power only with a further solar-related specification. A kilowatt peak (kWp) is the maximum power produced by a solar plant under standard temperature and sunlight conditions. The kilowatt peak specification is only relevant for solar plants, not for wind farms, here, we simply refer to kW.

So how much electricity will my solar plant produce?

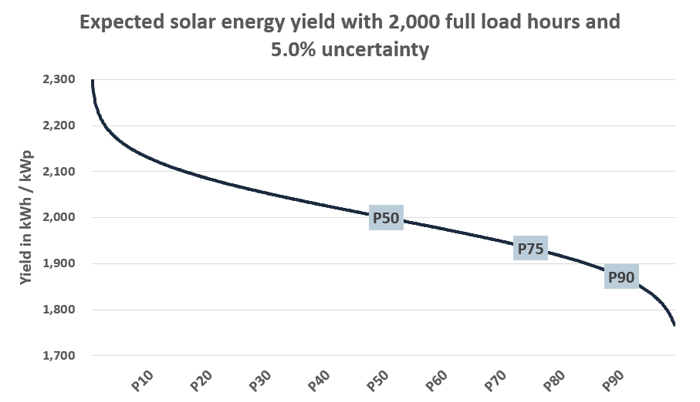

Well, this depends on where you live. If you live in sunny California, your solar plant might be able to run at 2,000 full load hours per year, while if you live in Germany, the same solar plant would most likely only run at 1,000 full load hours per year. So if you live in California, the same solar plant would produce 10 kWp x 2,000 hours = 20,000 kWh per year. While in cloudy Germany, you would end up with only 10 kWp x 1,000 hours = 10,000 kWh at the end of the year. Seems logical, right? If there are more sunny hours during the year, your solar plant should produce more electricity.

What are full load hours?

First of all, there are 8,760 hours in one year. This is a very important number within the renewables industry. If we go back to our solar plant in California, you might think there must be more than 2,000 sunny hours per year in California! And you are absolutely right!

While there might be about 3,000 sunny hours per year in a southern Californian city, your solar plant would primarily produce electricity (kWh) at a rate (kW) that is lower than its full capacity. Only during very sunny hours, right around noon, your plant will run at its full capacity (10 kWp). During the morning and afternoon hours, your plant might only run at half its capacity, i.e., 5 kWp. This would imply that during such hours your plant only produces 5 kWp x 1 hour = 5 kWh vs. 10 kWp x 1 hour = 10 kWh during the midday hours.

Full load hours make it much easier to interpret the electricity production potential at any given location. As the name implies, full load hours are the number of hours per year when a renewable energy asset produces electricity at its maximum capacity, i.e., installed capacity.

What is a capacity factor?

The capacity factor is a relative interpretation of full load hours. For example, a Swedish wind farm with an installed capacity of 12 MW (12,000 kW) and 3,000 full load hours would have a capacity factor of 3,000 full load hours / 8,760 hours per year = 34.2%. As a straightforward interpretation, our wind farm runs 34.2% of the year at its full capacity (12 MW), while during the remaining 65.8%, it would not produce any electricity at all.

Thus, the installed capacity is irrelevant to calculate the capacity factor. All we need to know is the number of full load hours.

How to properly determine the value of an asset in a financial model for renewable energy investments?

If you're looking to invest in renewable energy, you need a comprehensive financial model dashboard that summarizes all the key investment metrics relevant to your decision-making process.

Thisfinancial model dashboard for renewable energy investments is designed to help you make informed investment decisions with ease. It includes a detailed breakdown of the project's capital structure, allowing you to understand the financing mix of the project and the risks associated with each layer of the capital stack.

The dashboard also considers critical investment metrics such as IRR and NPV on both a levered and unlevered basis, giving you a complete picture of the project's profitability.

In addition to these essential investment ratios and multiples, the dashboard details the payback periods, CFADS/EV, Revenue/EV, EV/MWp, and EV/MWh. These metrics are crucial in evaluating the financial viability of the project and determining its potential for generating returns over the long term.

The dashboard also features eye-catching charts that provide a visual representation of the project's cash flow generation over its entire asset lifetime. This feature will give you valuable insights into the project's cash flow patterns and help you make informed investment decisions.

With all these critical investment metrics and data points in one place, this financial model dashboard is the ultimate tool for renewable energy investment decision-makers.

How to build a project finance model from scratch?

Do you want to learn how to build a project finance model from scratch? Then check out the Advanced Renewable Energy Financial Modeling course.