In a project finance deal, the seasonality of renewable energy revenues has a significant impact on monthly cashflows. Consequently, seasonality needs to be considered in a best-practice financial model for renewable energy investments.

What is the seasonality of renewable energy?

Everyone is aware of seasonal weather patterns throughout the year, especially the further you live away from the equator, the more severe the seasons will be. This seasonal effect impacts the production of renewable energy power plants.

Luckily, solar and wind production is at their energetic peaks at opposite periods of the year. While solar parks are at peak production during the summer months, wind farms produce most electricity in the winter.

How to model the seasonality of renewable energy?

Modeling seasonality in a monthly cash flow model is rather straightforward, while properly reflecting the seasonal effect in a quarterly model can be rather tricky if the model should keep its full flexibility.

First, irrespective of a monthly or quarterly model, the inputs for the seasonal production need to be set up on a relative basis throughout the year.

Above is an example of how a best-practice model for a wind investment reflects the seasonal inputs on a relative basis for each month. You may notice that in the above case, the strongest energy production occurs during the winter months.

Typically, the technical advisor of a transaction will provide the required seasonal input for the financial model. A check within the input sheet in the model ensures that the seasonality always sums up to 100%.

First, let's look at the more straightforward modeling of the seasonality in a monthly model.

You will immediately notice that implementing flags is a must to transparently model the seasonality effect of renewables. Afterward, the monthly generation profile percentage will simply be multiplied by the annual energy production.

Setting up the flags for a quarterly model is much tricker and requires careful consideration of different periodic effects.

The formula for the flags for the quarterly model ends up lengthy and complex. Consequently, this implementation may seem not like best practice modeling. However, this implementation is necessary to ensure the robustness and flexibility of the model so that any start period of the model can be considered.

Why even consider the seasonal effect in such detail?

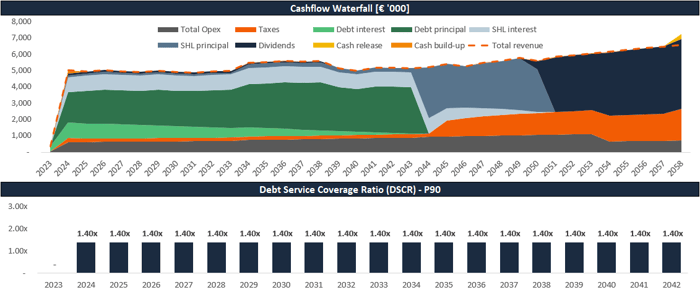

Lenders are keen on knowing the exact monthly cashflows that a project may generate as loan repayments typically occur more than once a year, i.e., on a quarterly or semi-annual basis.

Seasonality has a significant impact on the cash flow available for debt service (CFADS). Therefore, this seasonal impact can already be considered when determining the repayment profile of a loan through the use of debt sculpting.

How to build an advanced financial model for renewable energy investments?

Do you want to learn how to adequately implement the seasonality of renewable energy within a financial model created explicitly for renewable energy investments? Then check out the Advanced Renewable Energy Financial Modeling course.