Degradation reduces the electricity output of solar panels over time. These losses must be considered when building a financial model for a solar plant.

What exactly is degradation?

Nowadays, high-quality solar panels degrade at a rate of approximately 0.25% - 0.50% per year, which reduces the overall electricity output of a solar plant by 8.0% - 15.0% over a 30-year asset lifetime. This reduction in electricity output should underline why considering degradation in a financial model for renewable energy investments is so important.

There are different forms of degradation. Broadly speaking, they can be distinguished between mechanical and chemical causes from the solar module's exposure to light.

- Light-induced degradation (LID): In the first days of solar panels being exposed to sunlight, the panels' efficiency typically falls by approximately 1.0%. In addition, during the construction period, shipping and mounting effects can also lead to a slight reduction in the power output caused by micro-cracks in the panels.

- Potential-induced degradation (PID) & Light and elevated temperature-induced degradation (LeTID): Nowadays, PID-free & LeTID-free modules are available. Unlike LID - PID & LeTID can be avoided and do not necessarily affect all solar modules. PID occurs if the voltage of different module components, such as the frame and cells, operate at slightly different voltages, resulting in voltage leaks, ultimately reducing the overall energy output.

- Age-related degradation is the most important consideration when building a business case for solar parks in a financial model. High temperatures and exposure to sand, snow, ice, and rainfall result in micro-cracks, corrosion, cell contamination, and hardening of the crystalline silicon.

Overall it is reasonable to assume 1.0% of degradation for the first year of operation and long-term losses of 0.25% - 0.50% p.a. - however, we strongly recommend consulting a technical advisor to conduct a site-specific analysis for estimating degradation losses.

How to model degradation losses in a financial model?

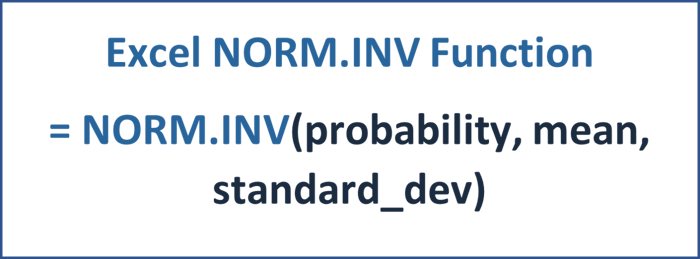

First, setting up proper modeling flags in Excel to activate different loss assumptions for different periods is important.

In the above example, flags have been implemented to activate periods of different loss assumptions. Thereafter, a short-term loss of 1.0% p.a. is assumed for the first operational year, while the long-term loss assumption due to degradation is assumed at 0.25% per annum.

How to properly reflect degradation losses in a financial model for renewable energy investments?

Do you want to learn how to model degradation losses within a financial model created explicitly for renewable energy investments? Then check out the Advanced Renewable Energy Financial Modeling course.