In a tax-related context, an interest barrier is a mechanism used to limit the amount of tax deductions that a company can claim on its interest expenses. An interest barrier provision specifies a maximum amount of interest expense that can be deducted in a given period.

The primary purpose of an interest barrier is to prevent companies from using excessive debt to reduce their taxable income. By limiting the amount of interest expense that can be deducted, an interest barrier makes it more difficult for companies to use debt and shareholder loans to minimize their tax payments.

Interest barriers can take various forms, but they usually involve a calculation that compares the amount of interest paid by the company to a specific percentage of the company's EBITDA – in the above example, this is calculated as 30% of EBITDA in row 791. If the amount of interest paid exceeds the limit set by the interest barrier, the excess amount is not tax-deductible. This can lead to higher tax liabilities for the company.

In some jurisdictions, the absolute annual amount of interest expense deductible may also apply. The SHL & debt interest barrier switch is on in the above example and set at EUR 1,000,000 per annum. This amount will depend on what barrier may be applicable in the respective project’s jurisdiction. The model also offers flexibility to differentiate between debt interest, SHL interest, and overall interest expense from debt and SHL for the interest barrier calculation—the inputs for which are selected in the Inputs_TI sheet.

How to consider an interest rate barrier within a financial model for renewable energy investments?

Learn how to consider an interest rate barrier within a financial model for renewable energy investments and enhance the decision-making process of your organization with a comprehensive financial model dashboard.

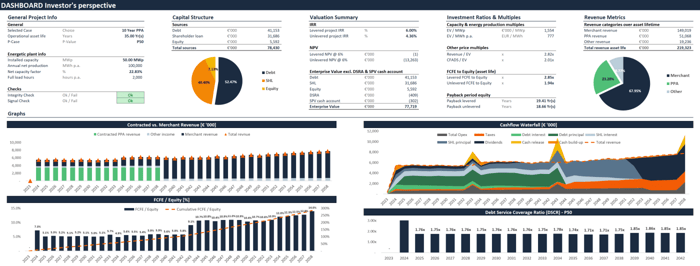

If you're looking to invest in renewable energy, you need a comprehensive financial model dashboard that summarizes all the key investment metrics relevant to your decision-making process.

This financial model dashboard for renewable energy investments is designed to help you make informed investment decisions with ease. It includes a detailed breakdown of the project's capital structure, allowing you to understand the financing mix of the project and the risks associated with each layer of the capital stack.

The dashboard also considers critical investment metrics such as IRR and NPV on both a levered and unlevered basis, giving you a complete picture of the project's profitability.

In addition to these essential investment ratios and multiples, the dashboard details the payback periods, CFADS/EV, Revenue/EV, EV/MWp, and EV/MWh. These metrics are crucial in evaluating the financial viability of the project and determining its potential for generating returns over the long term.

The dashboard also features eye-catching charts that provide a visual representation of the project's cash flow generation over its entire asset lifetime. This feature will give you valuable insights into the project's cash flow patterns and help you make informed investment decisions.

With all these critical investment metrics and data points in one place, this financial model dashboard is the ultimate tool for renewable energy investment decision-makers.

How to build an advanced financial model for renewable energy investments?

Do you want to learn how to build a financial model created explicitly for renewable energy investments? Then check out the Advanced Renewable Energy Financial Modeling course.