Sources and Uses of Funds: In the context of project finance, sources of funds refer to the various means by which a project can raise capital, while uses of funds refer to the different capital, financing, and operational expenditures that will be incurred throughout the project's development and construction phase.

Sources of funds can include equity, shareholder loans, senior debt, bank loans, bonds, and other financial instruments that can provide the necessary capital to fund the project. On the other hand, uses of funds can include construction and development costs, operational expenses, and debt service payments, mostly during the development and construction phases of a project.

In the development and construction of a renewable energy project, the largest portion of the uses of funds will most likely be used for the EPC agreement; EPC stands for Engineering, Procurement, and Construction.

It is essential to consider the sources and uses of funds when creating a project finance model. Understanding where the funds will come from and how they will be used allows investors to evaluate the potential risks and returns associated with the project.

Effects of sources of funds on the capital structure of a renewable energy project

The sources of funds can have significant effects on the capital structure of a renewable energy project. The capital structure refers to the way a project is financed, including the mix of debt and equity financing.

Equity financing in the form of share capital or shareholder loan can have a significant impact on the capital structure of a renewable energy project. Equity investors typically expect higher returns on their investment, but they also assume and accept more risk than lenders. As a result, equity financing can increase the cost of capital for the project.

On the other hand, debt financing, such as bank loans or bonds, can reduce the cost of capital and improve the project's financial leverage. Debt financing also allows the project to benefit from tax shields resulting from the interest payments – similar to a shareholder loan from an equity investor. However, taking on too much debt can increase the project's financial risk and make it more vulnerable to default.

In addition to equity and debt financing, other sources of funds, such as government grants or subsidies, can also affect the capital structure of a renewable energy project. These sources of funds can reduce the project's cost of capital, but they may also come with specific requirements or conditions that need to be met.

Overall, the sources and uses of funds can have a significant impact on the capital structure of a renewable energy project. The mix of equity and debt financing can affect the project's cost of capital, financial leverage, and ownership structure, among other factors. Careful consideration of the sources of funds is critical to developing a well-balanced and sustainable capital structure for the project.

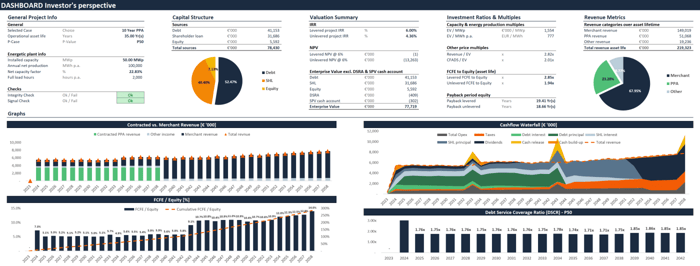

Below is the valuation dashboard used in our Advanced Renewable Energy Financial Modeling course. This online video course teaches you how to build a financial model with advanced capital structures from scratch.

How to build an advanced financial model for renewable energy investments?

Do you want to learn how to build a financial model created explicitly for renewable energy investments? Then check out the Advanced Renewable Energy Financial Modeling course.