XNPV function - determining the Net Present Value (NPV) of an investment with non-periodic cashflows.

What is the XNPV function?

The Excel XNPV function returns the Net Present Value (NPV) of an investment with non-regular cashflows. The XNPV function is much more flexible and precise than the regular NPV function, so it should always be preferred to use XNPV over NPV.

The main benefit of using XNPV is that it can calculate a precise NPV for an uneven cashflow series. This is especially beneficial for calculating the NPV of project financings and is used as best practice in the context of financial modeling for renewable energy investments.

How to use XNPV using Excel?

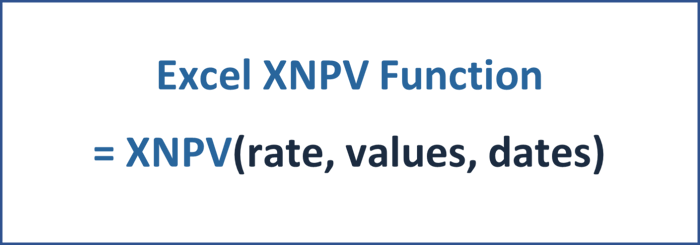

The XNPV function uses three inputs, all of which are required.

- The first argument, rate, is the project's and/or investor's required rate of return. All cashflows which are generated over the asset's lifetime will be discounted at this rate of return.

- The second argument, values, requires the range of cashflows (both positive cash inflows and negative cash outflows) that the investment/project generates.

- The last argument, dates, requires the range of dates which are linked to each specific cashflow of the second range.

What's important to consider when using XNPV?

First, the length of both ranges for the last two arguments must match exactly to ensure that Excel can link each cashflow to a specific date.

Second, the value range of cashflows does always need to start with a negative number as an investment typically requires an initial cash outflow - at least, this is how Excel thinks in the manner of this function. If the first number within the value range is not negative, the function will not work - however, there is a workaround: simply use a very small negative number for the first value. Below is an example of how the XNPV function is applied in a typical project finance model for renewable energy investments.

XNPV vs. NPV function - what's the difference?

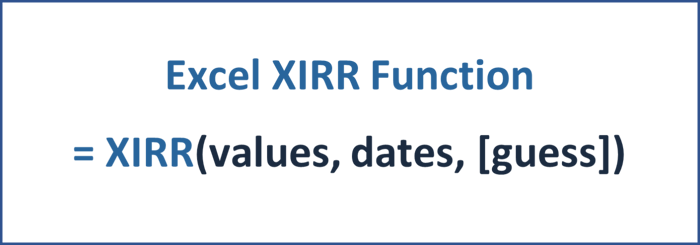

The NPV function is much less flexible than the XNPV function and does not require any dates as input. The output is the same - the Net Present Value of the investment - however, when using the NPV function, Excel assumes that between each given value for a cashflow lay precisely 12 months.

As it is highly improbable to encounter an investment in the real world with only one cashflow at the end of each year, it is recommended to always prefer the XNPV function over the NPV function.

The XNPV function has the flexibility to consider different cashflows daily, which is why it uses daily compounding, while the NPV function uses simple annual compounding.

What does the NPV tell me as an investor?

Investors often view the Net Present Value as one of the most crucial investment metrics. Generally, the rule for an investment decision is to invest in the project if the NPV is positive and not to invest if the NPV is negative.

Why invest in a project that is NPV-positive? A positive NPV implies that the investment generates a higher return than the required rate of return at which all future cashflows are discounted.

But the critical question a sophisticated investor will ask is how much return the investment generates exactly? This is where the Internal Rate of Return (IRR) comes into play.

From a mathematical standpoint, the IRR is the required discount rate for all future cashflows, which sets the investment's Net Present Value (NPV) to zero. This implies that if an investor invests specific payments in accordance with all the negative cash outflows of the input range of the XIRR function - he or she will earn the IRR as a return over the entire lifetime of the asset.

How to properly apply the XNPV function in a financial model for renewable energy investments?

Do you want to learn how to model the XNPV function within a financial model created explicitly for renewable energy investments? Then check out the Advanced Renewable Energy Financial Modeling course.

Article sources