BESS Merchant Energy Arbitrage Model in Excel

BESS Merchant Energy Arbitrage sounds simple on paper: charge when prices are low, discharge when prices are high, and pocket the spread. But if you’ve ever tried to translate that story into a...

BESS Merchant Energy Arbitrage sounds simple on paper: charge when prices are low, discharge when prices are high, and pocket the spread. But if you’ve ever tried to translate that story into a...

A BESS Tolling Agreement sounds almost too easy to model: take contracted capacity, multiply by a fixed $/kW-month price, apply escalation, and you’re done. In practice, that shortcut is...

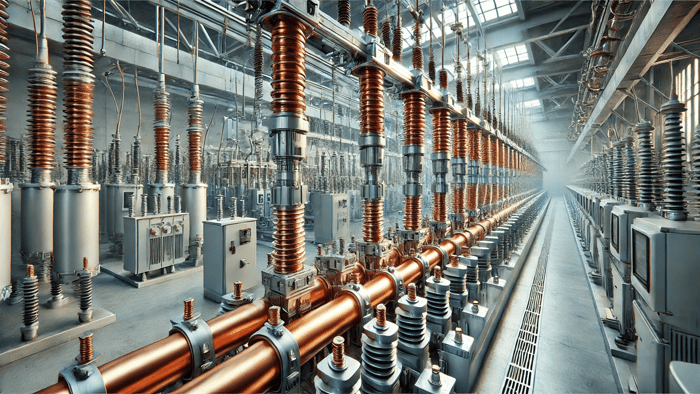

A battery is sold as an AC product at the point of interconnection (POI): a defined power rating (MW) sustained for a defined duration (hours). The challenge is that the asset behind that product...

AC vs DC in Battery Energy Storage is the single biggest source of confusion in BESS modeling. Batteries store energy on the DC side, but markets, meters, and cash flows live on the AC side—so...

In project finance, understanding how debt sizing works is a foundational skill — especially in renewable energy deals where production output is uncertain. One of the most commonly tested —...

Understanding the 3 Statement Model is a crucial skill for anyone working in project finance, infrastructure investing, or renewable energy transactions. It’s the foundation for integrating financial logic,...

Can You Pass This Project Finance Modeling Test? Suppose you're preparing for interviews in infrastructure finance, private equity, or investment banking. In that case, chances are you’ll face...

Renewable energy projects depend on federal tax incentives to drive down capital costs and improve project returns. The debate of ITC vs PTC is a crucial one for developers and finance professionals alike....

The U.S. renewable energy market relies on innovative financing tools to unlock the full potential of federal incentives. Tax Equity is one such tool that monetizes federal tax credits and depreciation...

In the world of project finance, accurately modeling financial mechanisms is critical to ensuring the long-term success of a project. One such mechanism is the Debt Service Reserve Facility (DSRF),...

In the evolving landscape of renewable energy project finance, a deep understanding of financing instruments is crucial for both aspiring analysts and seasoned professionals. One such instrument known...

Imagine securing a long-term power purchase agreement for a new wind or solar project, only to discover that your actual revenue fluctuates wildly due to unpredictable grid congestion costs and transmission...

A project finance deal is a complex transaction that brings together a diverse array of stakeholders, each playing a crucial role in ensuring the project's success. Whether you're a finance...

In renewable energy project finance, structuring debt is crucial to optimizing a project's return and attractiveness to investors. Two commonly used financing structures are term loans and revolving...