Since the end of 2021, electricity prices in Europe are surging to highs never seen before - is it all to be blamed on rising gas prices, or may there be a systemic failure in how electricity prices are determined? Of course, one could argue that it is both - suddenly skyrocketing spot and forward prices are caused by the increase in gas prices - however, the root of the problem lies within the determination of electricity prices, more specifically, the Merit Order Effect.

What is the Merit Order Effect?

During the late 1990s, electricity markets in Europe underwent an unbundling process that predominantly aimed at integrating competitive forces into the electricity pricing process to achieve an increased efficiency of electricity supply. The idea of unbundled electricity markets was to implement an order to enforce a rewarding mechanism for low-cost producing power plants.

This mechanism was the birth of the "Merit Order." From a traditional supply & demand perspective, the variable cost of the last megawatt-hour (MWh) produced on the supply side, which is needed to match the current electricity demand, determines the overall spot price at the electricity exchange.

Below is a well-functioning Merit Order system. The current electricity demand of roughly 47 GW is covered by 21 GW of renewable energy, 20 GW of nuclear energy, and 6 GW of lignite & hard coal energy.

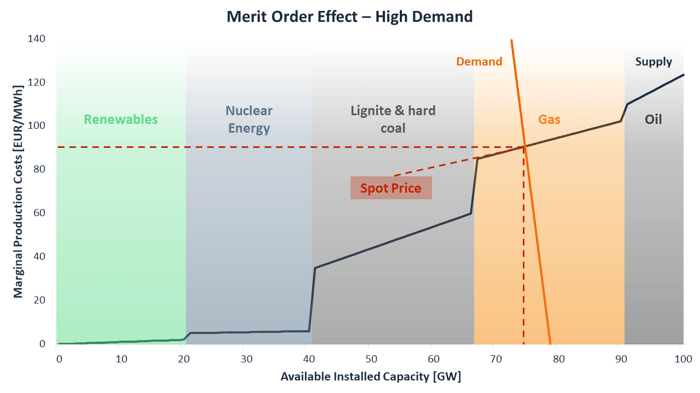

Note that the electricity demand is very inelastic but highly volatile throughout the day. Depending on the hour of the day, the electricity demand might surge suddenly (i.e., people get home from work and turn on their private appliances). The below graph shows increased demand during a peak hour.

Why is gas so important in the electricity pricing mechanism?

Gas & oil are the most flexible energy sources on the supply-side as such power plants can be turned on within seconds/minutes. Typically, coal plants can reach their maximum capacity within 2 - 6 hours, which requires efficient planning of production adjustments - however, smaller adjustments in production require less time. Even worse are nuclear reactors; once turned off, it requires 1 - 3 days to turn them back on. Consequently, most nuclear plants run all year long every day and create the foundation of the baseload.

Most renewable plants do not have variable production costs (compared to conventional energy sources, which require fossil fuels). In addition, most governments require a systemic priority for electricity produced from renewable sources. Contradictory, rising complexity is caused by increased installed capacities of renewable plants and the resulting unpredictable renewable energy production from wind or solar energy.

So if renewable energy has a systemic advantage within a Merit Order pricing system, what does this imply for the development of electricity prices?

More renewable energy production facilities result in increased unpredictability of electricity production and consequently a need for an energy source that can guarantee more flexibility in production, which - at a larger scale - can currently only be provided by gas turbines.

Short- and long-term outlook for the Merit Order

Currently, gas prices across Europe are at highs never seen before, which enables renewable energy investors who are not contractually bound to power purchase agreements ("PPAs") to realize high profits if they sell the produced energy in the spot market.

In addition, some governments in Europe have decided to turn off or phase out their nuclear reactors over the next years.

Investors invested in renewable energy assets can expect high short-term profits considering the above effects.

However, the long-term outlook for renewable energy investors might not be as promising, assuming the merit order pricing mechanism stays as is. Increased renewables production pushes prices to zero if the supply matches the current demand. Even worse - if the renewables supply exceeds current demand, electricity prices might turn negative, incentivizing industrial consumers with variable pricing contracts to take off more electricity, ensuring grid stability which causes renewables investors to lose money if they are not able to switch off their plants before such pricing shifts occur. Historically, negative spot prices have increased, and such an effect is expected to rise further across different European jurisdictions.

Long-term electricity prices

Investors should expect much more volatility within electricity prices throughout the day as, on the one hand, marginal production costs of gas or coal will be the determining price force during peak times or, on the other hand, high renewables production in combination with low or normal demand will push prices to zero or a negative level.

For the sake of completeness, it has to be stated that storage technologies such as batteries or pump storage can counteract this phenomenon through increased flexibility in energy demand.

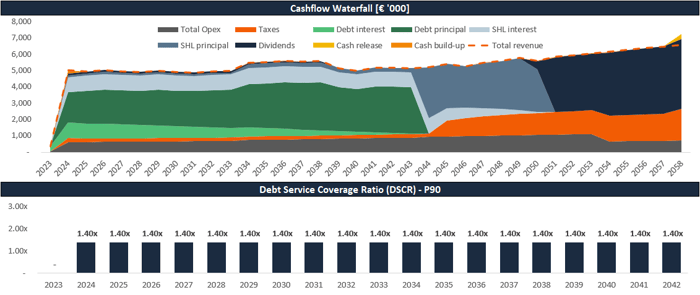

Valuation of renewable energy investments using financial modeling

Do you want to learn how to value renewable energy investments? Then check out the Renewable Energy Financial Modeling course of Renewables Valuation Institute.