Bilaterally concluded power purchase agreements ("PPAs") are becoming increasingly popular in the renewables industry; thus, knowing how to model PPA offtake agreements becomes critical. In addition, many state-subsidized feed-in tariffs ("FiTs") become rarer as governments observe that most renewable energy projects are economically viable without subsidies. Consequently, project developers are willing to develop such projects without government-backed support regimes. Furthermore, investors are eager to invest their funds into business cases based on merchant price forecasts often combined with PPAs.

So what exactly is a PPA?

Power purchase agreements are contractual agreements between two parties, one party selling electricity ("Generator") and one party buying it ("Offtaker"). Typically, PPAs are concluded over extended periods between 5 and up to 20+ years.

Energy seller = Generator

Energy buyer = Offtaker

Why are PPAs popular?

PPAs enable equity and debt investors to have price certainty for the produced electricity. PPAs are concluded at a fixed price for each electricity unit generated. For instance, a PPA can have a fixed price of 40 EUR/MWh over 10 years. Depending on the contractual offtake structure, PPAs can cover the entirety of energy produced, or only a certain percentage of production can be hedged. The hedging ratio determines how much of the generated electricity is sold at the contractually agreed fixed price and what portion is sold in the spot market with merchant price risk exposure. For example, a typical PPA structure for a renewable project may have a 10-year term with 70% hedged volume at a 40 EUR/MWh fixed price.

PPAs - pros and cons

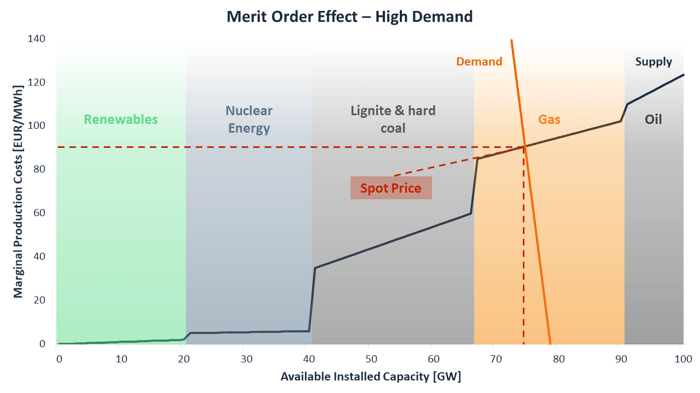

While PPAs give price certainty over the contractually concluded period, this certainty in predictable cash flows typically comes at a significant discount against forecasted merchant prices. Offtakers are usually only willing to enter into PPA offtake agreements to save money in the long run. Historically and depending on the jurisdiction, a 20 - 30% discount was observable between observable spot prices at the time of contractual conclusion and the fixed price underlying the PPA. So why even conclude a PPA as an investor? Most debt investors are only willing to enter into project finance agreements if they have some certainty of future cash flows in the form of fixed-price PPAs. Often, there is no project debt financing available based on a full merchant business case unless the financing conditions are substantially more conservative, i.e., higher minimum DSCRs and higher interest rates. Consequently, if equity investors want to use higher gearing, i.e., sculpted debt financing, to maximize their return, they are often forced to enter into such agreements.

How to properly model a PPA in a financial model for renewable energy investments?

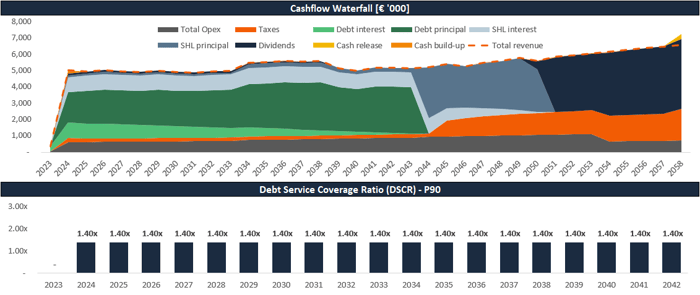

If you're looking to invest in renewable energy, you need a comprehensive financial model dashboard that summarizes all the key investment metrics relevant to your decision-making process.

This financial model dashboard for renewable energy investments is designed to help you make informed investment decisions with ease. It includes a detailed breakdown of the project's capital structure, allowing you to understand the financing mix of the project and the risks associated with each layer of the capital stack.

The dashboard also considers critical investment metrics such as IRR and NPV on both a levered and unlevered basis, giving you a complete picture of the project's profitability.

In addition to these essential investment ratios and multiples, the dashboard details the payback periods, CFADS/EV, Revenue/EV, EV/MWp, and EV/MWh. These metrics are crucial in evaluating the financial viability of the project and determining its potential for generating returns over the long term.

The dashboard also features eye-catching charts that provide a visual representation of the project's cash flow generation over its entire asset lifetime. This feature will give you valuable insights into the project's cash flow patterns and help you make informed investment decisions.

With all these critical investment metrics and data points in one place, this financial model dashboard is the ultimate tool for renewable energy investment decision-makers.

How to build a project finance model from scratch?

Do you want to learn how to build a project finance model from scratch? Then check out the Advanced Renewable Energy Financial Modeling course.